what is open end credit agreement

It helps borrowers to. Download Template Fill in the Blanks Job Done.

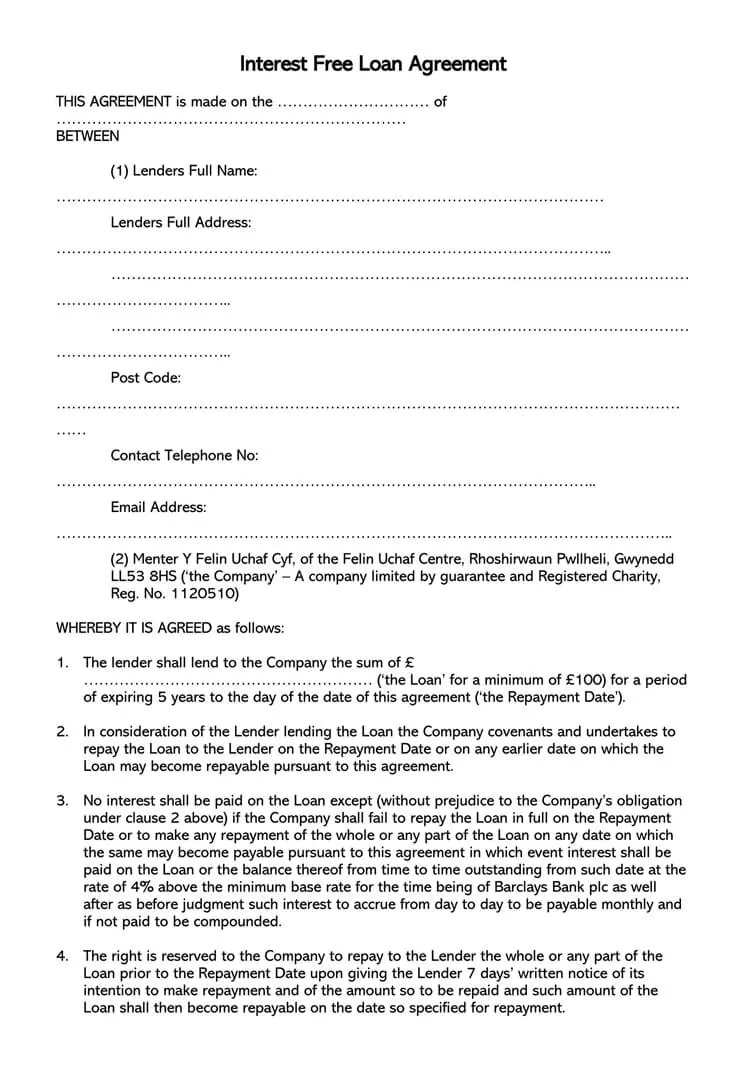

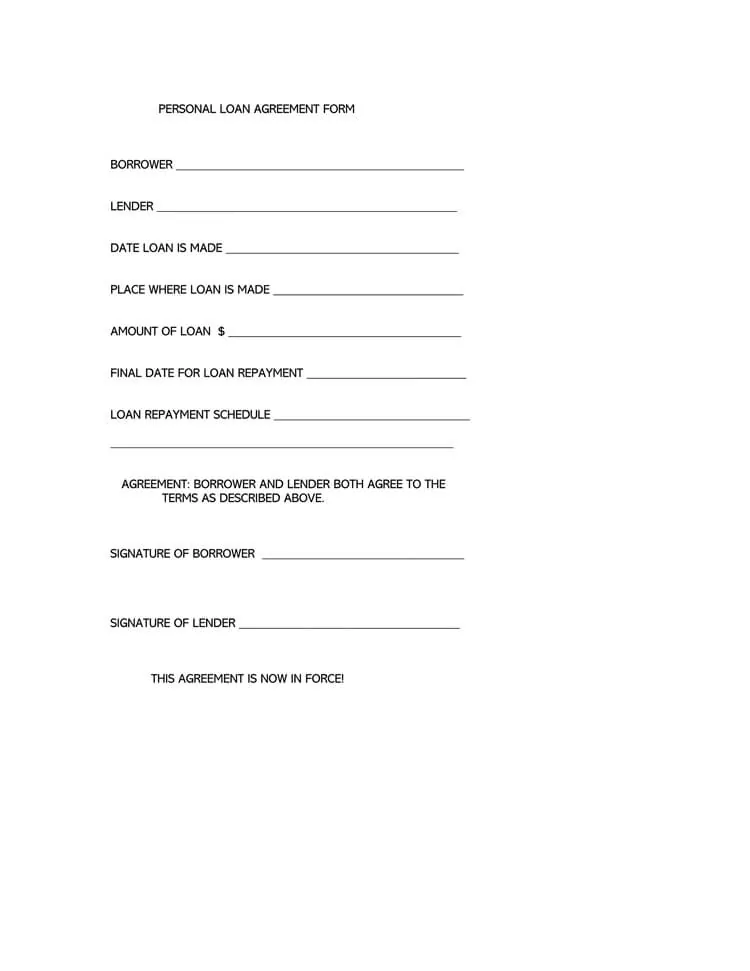

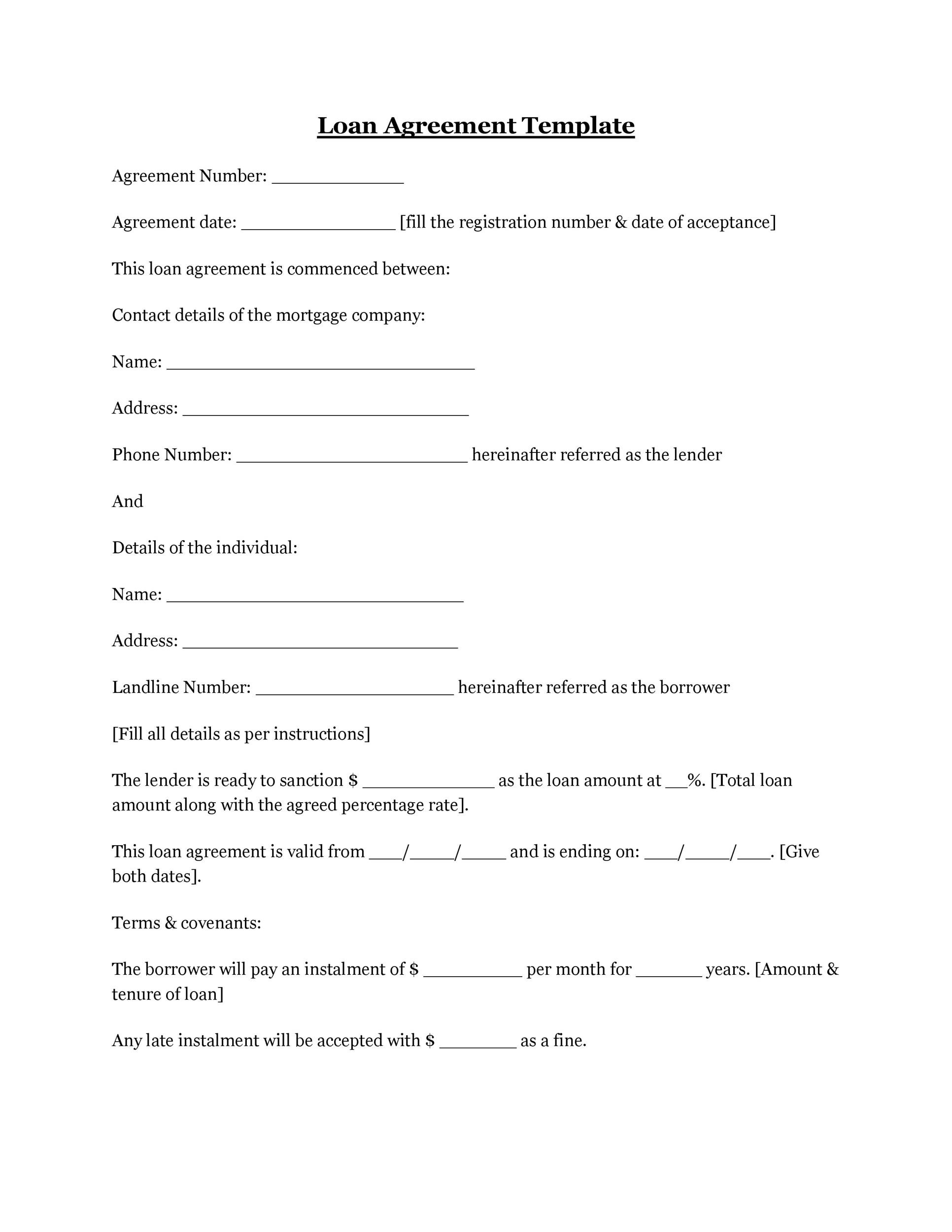

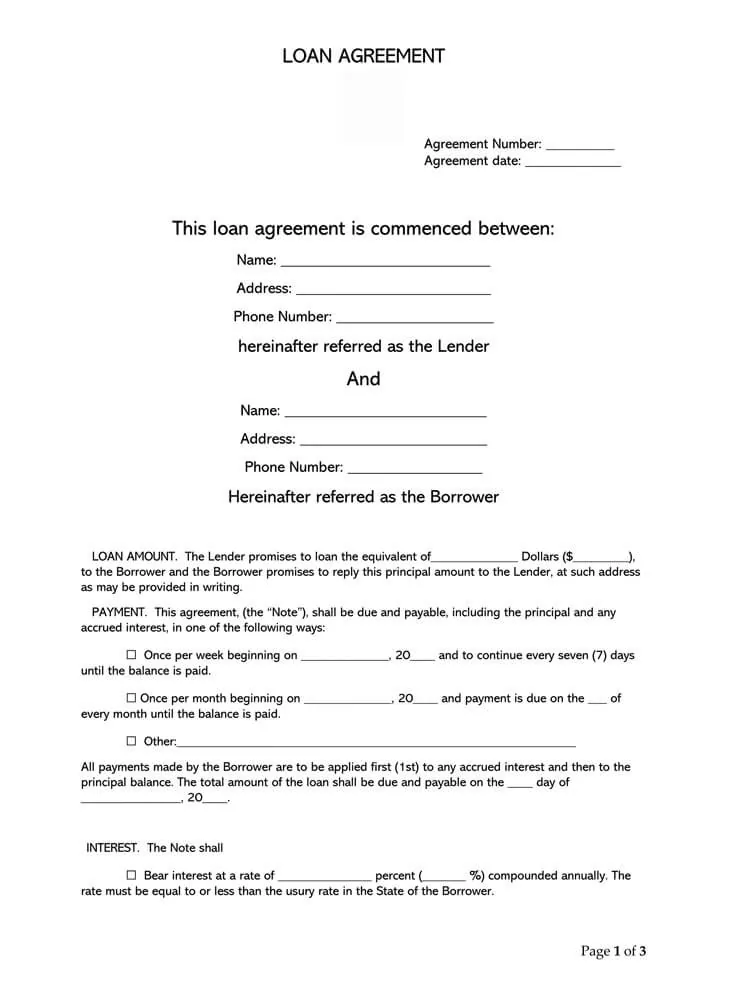

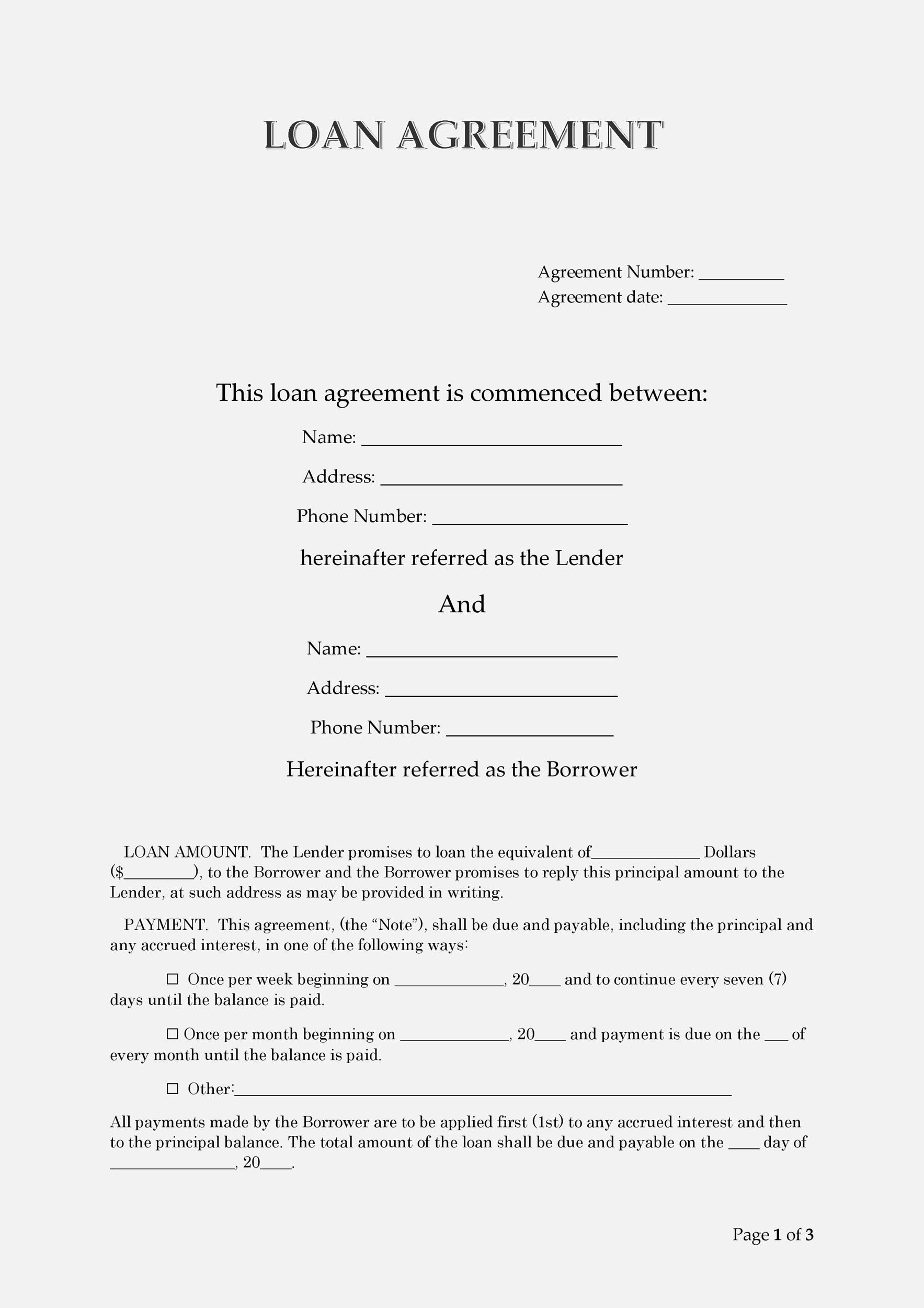

38 Free Loan Agreement Templates Forms Word Pdf

This type of credit has a limit that cant be exceeded without penalty charges.

. Under a line of credit agreement the consumer takes out a loan that allows payment for expenses using special checks or increasingly a plastic. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. Open end credit allows you to put money in and take money out as through a cash withdrawal or by making a charge.

Ad Vast library of fillable legal documents. Open-end credit means credit extended by a creditor under an agreement in which. A line of credit is a type of open-end credit.

Closed-end credit is a loan or credit agreement signed by a lender and a borrower that includes information regarding the amount borrowed interest rates and charges and monthly payments payable depending on the borrowers credit rating. Joe Manchin on Wednesday announced a deal on an energy and health care bill representing a breakthrough after more than a year of negotiations that. A line of credit is a type of open-end credit.

A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit. Related to Open-end credit plan. With an open-end credit agreement the lender usually a bank approves the borrower for a maximum total loan.

A type of revolving account that permits an individual to pay on a monthly basis only a portion of the total amount due. Wests Encyclopedia of American Law edition 2. Best tool to create edit share PDFs.

Closed end credit cannot be altered once the agreement is signed. In the case of a credit card account under an open end consumer credit plan under which a late fee or charge may be imposed due to the failure of the obligor to make payment on or before the due date for such payment the periodic statement required under subsection b with respect to the account shall include in a conspicuous location on the. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as needed. The following terms apply to this Open-End Credit Agreement and Disclosure Agreement. Edit with Office GoogleDocs iWork etc.

State-specific Legal Forms Form Packages for Investing Services. The conditions under which finance charges will be imposed. Open-end credit means a plan under which the creditor reasonably contemplates repeated transactions which prescribes the terms of those transactions and which provides for a finance charge which may be computed from time to time on the outstanding unpaid balance.

It most frequently covers a series of transactions in which case when the customers line of credit is nearly exhausted or not replenished the customer is expected to reduce the indebtedness by submitting payments to the bank before making additional use of the line of credit. If the principal is repaid during the time period of the line then the maximum amount or any lesser amount may be drawn down. Ad Streamlined Document Workflows for Any Industry.

Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan. PdfFiller allows users to edit sign fill and share all type of documents online. Any period called a grace period within which the balance may be paid to avoid a finance charge.

A revolving loan issued by a financial institutionit may be secured by a mortgage or other collateral or unsecuredThe borrower may draw down the line up to the maximum limits at any time and pay interest each month. DIP Credit Agreement means that certain Revolving Credit Term Loan and Guaranty Agreement dated as of January 9 2007 by and among the Debtors the DIP Agent and the DIP Lenders which was executed by the Debtors in connection with the DIP Facility as. Before you make the first transaction under an open end credit agreement the business must disclose to you in a single written document the following items.

Open-end credit means credit extended by a creditor under an agreement in which. Open-end credit allows or enables borrowers to purchase repeatedly with an open end credit line. An open-end lease is a contractual agreement between a lessor owner and the lessee renter that holds the lessee responsible for the value of the property.

Open-end mortgages combine the benefits of a traditional mortgage and a HELOC. E the annual percentage rate using that term which shall be disclosed as i if at the time the petition is filed the debt is an extension of credit under an open end credit plan as the terms credit and open end credit plan are defined in section 103 of the truth in lending act then i the annual percentage rate determined under. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

Both closed end and open end credit are perfectly designed for different. It is a pre-approved loan from a financial institution which controls the amount a borrower can borrow. Unlike other loans in which the borrower has to take the total loan all at once this loan is open.

Ad Download Our Credit Agreement All 2000 Essential Business and Legal Templates. This means the borrower is allowed to use only a portion or the entirety of the loan whenever he or she wants. The final payment of an open-end lease is based on the difference between the residual projected value of the property leased and its realized actual value.

The acquisition of a closed-end credit is a solid indicator of the borrowers good credit rating. Find Forms for Your Industry in Minutes. 2 days agoSenate Majority Leader Chuck Schumer and Sen.

Open-end mortgages can provide flexibility but limit you to what you were. This type of Consumer Credit is frequently used in conjunction with bank and department store credit cards. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed.

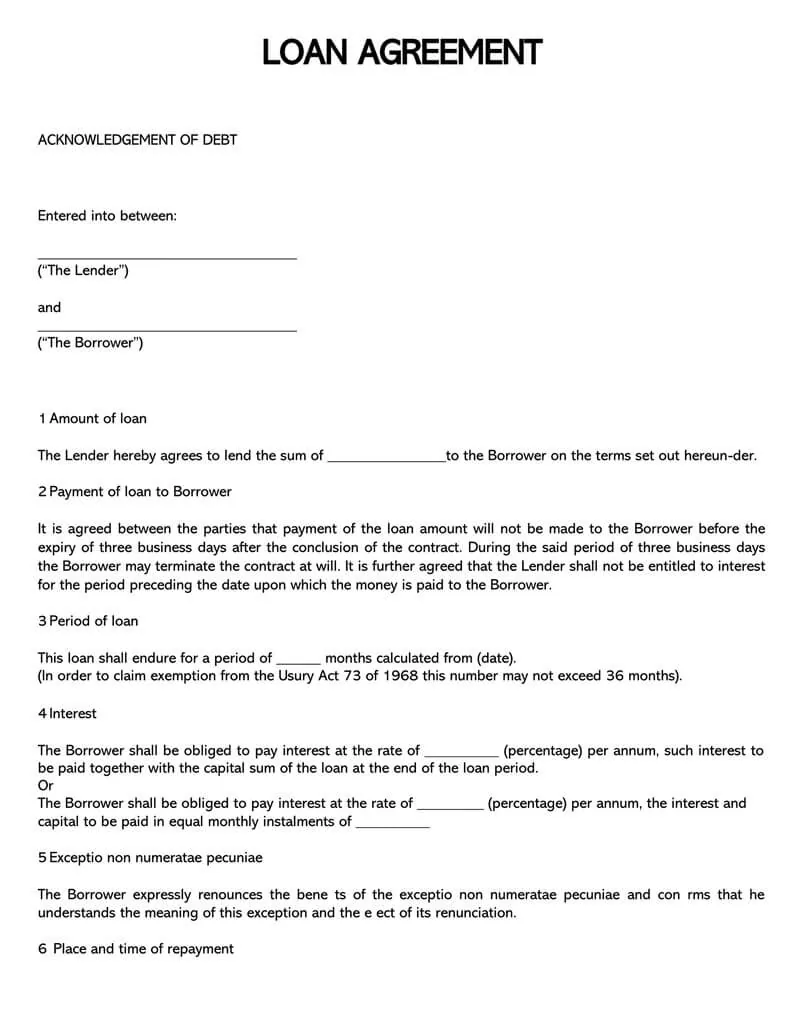

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

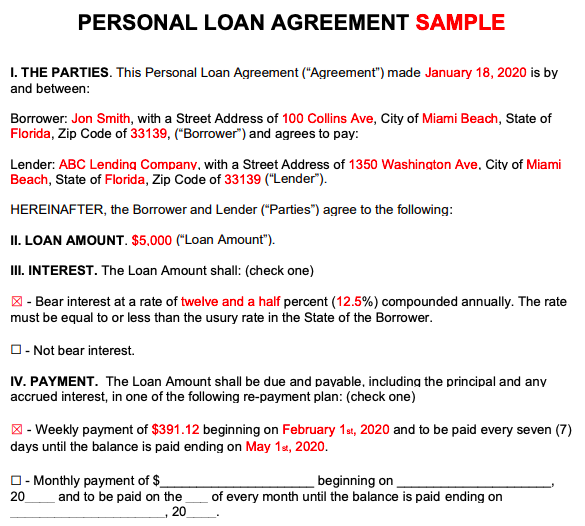

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Free Seller Financing Addendum To Purchase Agreement Word Pdf Eforms

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Personal Loan Agreement How To Create This Borrowing Contract Lendingtree

How To Write A Loan Agreement Between Friends With Pictures

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

38 Free Loan Agreement Templates Forms Word Pdf

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Free Personal Loan Agreement Template Sample Word Pdf Eforms

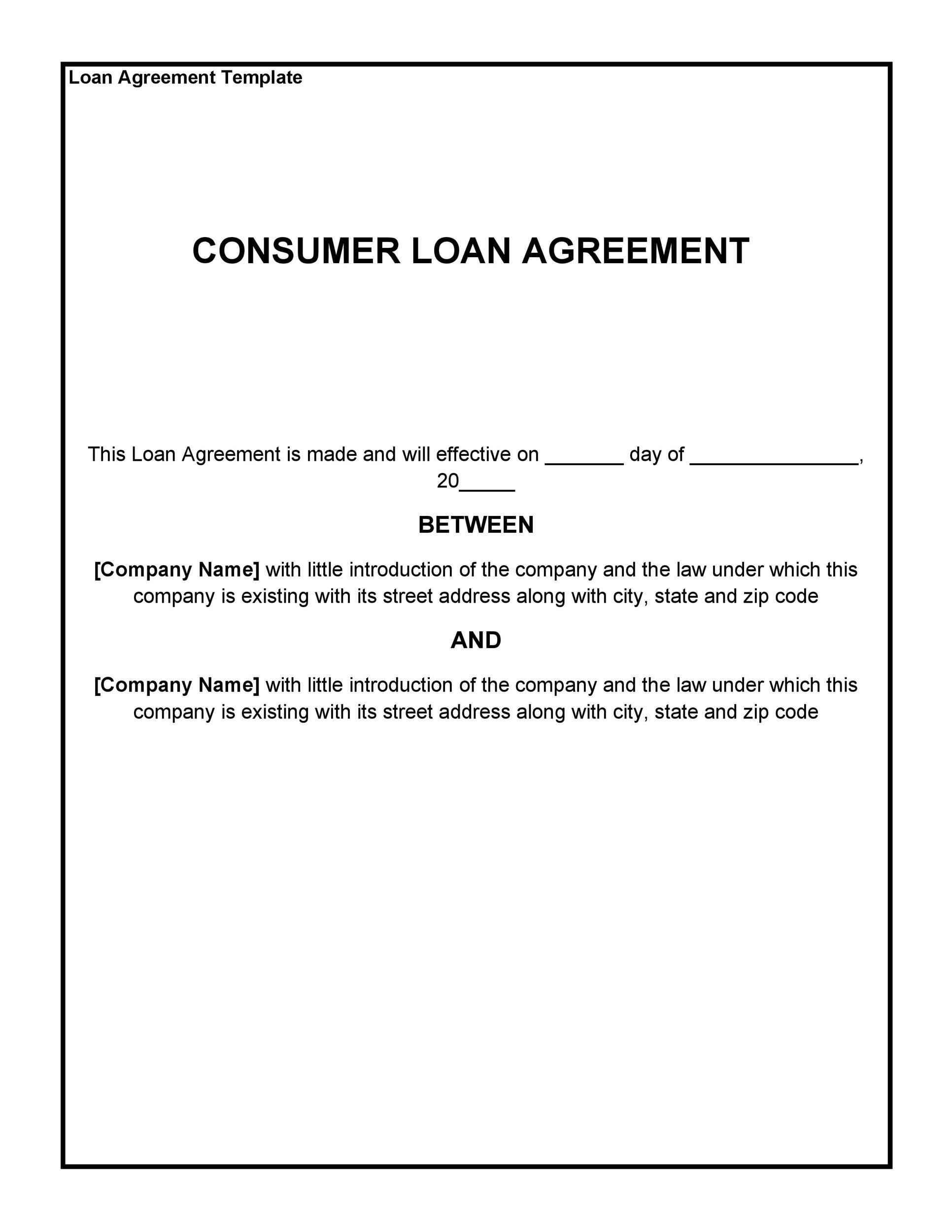

45 Free Loan Agreement Templates Samples Word Pdf

38 Free Loan Agreement Templates Forms Word Pdf

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

45 Free Loan Agreement Templates Samples Word Pdf

/GettyImages-917891912-a3aea31808e640578a57ccabd93c055d.jpg)